Dave Potter says Massachusetts ADUs typically cost $200–$300 per sq ft, and matching the main home’s finishes helps value. He cites a 900-sq-ft build costing $270K that could add roughly $450K in resale, plus strong rental demand that can help qualify for mortgages. He favors stick-built ADUs for design control; prefab saves little because the expensive parts are foundation, utilities, and site work. Detached units may require separate water and sewer lines, sometimes $30K–$50K. Popular funding includes HELOCs or cash, and with a 900-sq-ft max, many owners see both quality-of-life and investment returns.

John Maher: Hi, I am John Maher. I’m here today with Dave Potter. Dave has been a licensed builder and real estate developer since 1980, and he’s completed hundreds of projects in his career. Now Dave is specializing in accessory dwelling units or ADU in Massachusetts. Today we’re talking about breaking down ADU costs and ROI. Welcome Dave.

Dave Potter: How you doing, John? Good to be here.

Typical Cost Of An ADU

John: Good, thanks. Dave, what’s the typical cost range for an ADU in Massachusetts?

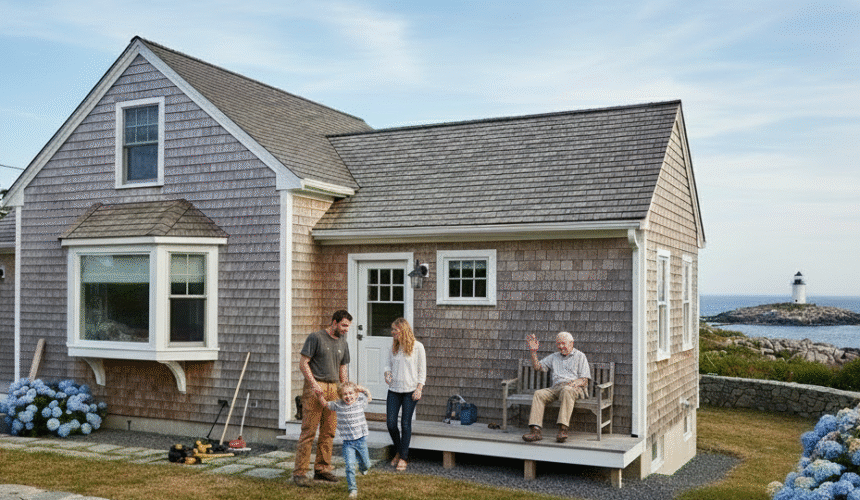

Dave: It’s in line per square foot with actually building a house or renovating a house, we’re seeing numbers right around $200 to $300 a square foot, depending on the complexity and the finishes that are involved. If you have a house that, and we try to match the finishes in the design of the existing house because if not, you’re going to get something that really doesn’t look right.

It really is not going to improve the value of your property as much as if it was to look like it’s always been there. So, that’s what we try to do when we do that. I work with some architects that do that. They do a good job of doing that, and so that’s what happens there. So it’s anywhere from $200 to $300 a square foot.

Do ADUs Increase the Value of a Home?

John: And do you find that ADUs increase the home’s value? And again, can you give us a case study or two that shows ROI?

Dave: Sure. Well, if you look at the numbers themselves, if you have a property, if you have a single family house say, and you’re going to sell it for $500 a square foot, and you’re going to spend $300 a square foot to install an ADU to build an in-law apartment or build an additional apartment or even build a building in the back free standing, and you’re going to spend $300 a square foot, and then you want to turn around and you say, you know something, I decided to move to Florida right now. I’m gone.

I’m going to sell the property. Right now, you’ve just increased the property value by $500 a square foot for whatever you built the ADU. So if you built a 900 square foot ADU and you spent $270,000 building it and you decide to sell it, the next day you’ve increased the vet and you’re getting $500 a square foot in that neighborhood for your houses just like yours, and now all of a sudden you have additional 900 square feet, you’ve just increased the value of that house by $450,000 and you only spend $270,000 bucks overnight. That’s amazing. Return on investment, you’re talking about 50%, 40% return on investment overnight. And so, just looking at it from an investment point of view, from a family point of view or a quality of life point of view, just from an investment point of view, this things makes enormous sense.

Major Market for Bringing Family Together

John: So, people out there on the market are really looking for these types of houses that have in-law apartments say, because like you said, there’s a housing shortage. People are looking for ways that they can have their family in their home and also maybe their mother and father-in-law or something like that.

Dave: Exactly. Very, very popular. They sell instantly. Once they go out there, the first open house, they’ll have five different offers. Even in today, market is a little bit slower right this second. Even today, if there’s anything with an in-law or apartment or an ADU, it goes right away because people can know, they can rent that out to help them with the mortgage payment. They can rent it out legally.

That means that the bank can take that rental income and help you qualify for the mortgage. That means that they can, even if they have a home office and they want to be really separate from somebody, they can have their home office in the ADU, even if they have older kids, they can stick their older kids in the ADU.

If they have a parent grandparents, they can stick them in the ADU. When I say stick, I mean they can move into the ADU. I don’t mean stick them in because some of these ADUs are probably better than the existing freestanding house. So, it’s a good way to be stuck, but some of them are really, really nice.

Options For Building An ADU

John: Now, can you get a prefab ADU or do you do stick-built ADUs? How would they compare in costs and quality?

Dave: I have been a builder since 1980 and everybody says, oh, you should just put prefab on certain things. And here’s the thing with the prefab modular homes, they’ve come a long way since I started, but they’ve given you all of the easy stuff. The hard part in Massachusetts is the foundation. It’s the design, it’s the water and the sewer, it’s the heating system. It’s all of that.

That’s the hard part. The modular company’s not giving you that. They’re just giving you the easy stuff. That’s all I had to do was build a frame and sheetrock it and inside it and put a roof on it. I could build a thing for $50 a square foot, but I have to do all of the other hard stuff. That’s why it costs 200 to $300 a square foot.

So, I’m not a big firm believer in the modular. Most of the inspectors, they really look at the modulars kind of like and say they can’t by law, but they want to really see what’s going on with this modular at all points. And like I said, they’ve come up a long way. We don’t do that. We stick build everything. We have local craftsmen that have been working with me for decades, and we come in there, we do a fantastic job, and I just think I have greater control.

You can do better design. A lot of these houses are in Massachusetts. They have a lot of details and a lot of work that you really can’t replicate in a modular home. Maybe in California. ADU is are widely, they’re in the most populous state for ADUs and everybody, what they do there is they just stick ’em in the backyard. All they have to do is scratch the dirt and stick the thing in there, put ’em on cinder blocks and you’re done. So, then maybe the modulars work, they just show up, stick it on there, and they run a couple pipes to it and they’re done.

John: It’s basically like buying a shed.

Dave: Just sticking it in your backyard. Yeah, exactly. Like buying a shed. But that doesn’t work in Massachusetts. You actually have to put it on a foundation because this thing’s going to move if you don’t, and you actually have to put water. And lot of towns and cities don’t let you put water and sewer

If you have an external building, a freestanding building, that’s going to be an ADU, which is legal, which isn’t a bad idea in some cases, but you have to put another water and sewer going from the street all the way to there. Now, that’s not cheap, and especially if they just redid the street, all of a sudden you’re talking a 30, 40, $50,000 job just to get the water and sewer there.

You can’t go through the existing house if you add on or if you put an in-law apartment in the basement or you put it over the garage that’s there, you can go through the house to come up there. But…

Financing Options for ADUs

John: Yeah, so that’s an important consideration. What are some of the financing paths that people use that are the most popular?

Dave: Well, a lot of people are taking out HELOCs to do this because they don’t want to touch their existing loan. If they already have an existing loan, three or 4%. And a lot of people are just, they have the funding for it. It’s a lot of money, but it’s not that much money. It’s 200, 300 square foot maximum 900 square feet, $270,000. And for them, they say it’s worth it. And even if they take out a second loan or refinance the house, which you don’t see a lot of that, if they have those three and 4% loans or if they’re buying a house that has one installed already more than pays for itself if they’re going to rent it.

John: All right. Well, that’s really great information, Dave. Thanks again for speaking with me today.

Dave: Thank you, John. Good to be here.

John: And for more information about Dave and ADU projects in Massachusetts, visit davepotteradu.com or call 66-BUILD-ADU. That’s 662-845-3238.